Innovator With A Story?

Who Are We?

The thought leadership arm of Joseph Raczynski, we speak with the best and most innovative global companies and personalities.

Conversations cover the latest trends in technology and go in-depth on the philosophical implications of these new technologies. We primarily cover emerging technology including Agentic AI, Blockchain, cybersecurity, NFTs, cryptocurrency and general business digital transformation.

Articles (350+)

-

Davos: a veritable petri dish of intellectual fermentation, where last week the crème de la crème of global thought leaders, and lowly me, converged to engage in a cerebral tango. It was a snow-globe of ideas, vigorously shaken and set loose upon the unsuspecting Alpine slopes. Here, I saw billionaires…

-

Agentic AI: The Next Frontier in Blockchain and Crypto

This is a primer for a presentation I will be giving in Davos. As we venture into 2025, a new technological paradigm is emerging at the intersection of artificial intelligence and blockchain: Agentic AI. This groundbreaking development promises to revolutionize how we interact with digital systems, particularly in the realm…

-

Davos: Where the World’s Movers and Shakers Gather (and Sometimes Slip on Ice)

Picture this: A quaint Swiss town nestled in the Alps, where the air is crisp, the snow is pristine, and the concentration of power suits per square meter blows away even the pinstripes of Wall Street. Welcome to Davos, home of the World Economic Forum’s Annual Meeting, where global leaders…

-

I’m Headed to Davos!

Hold onto your lederhosen, folks! I am extraordinarily excited and fortunate to be attending Davos this year for the World Economic Forum in Switzerland. As a delegate for The Digital Economist, I’ll be preaching about my two favorite topics, AI and Blockchain on Monday, January 20th. More details to come,…

-

Tech-Savvy Lawyering: Non-AI Trends You Need to Know

Written for the ABA Center for Innovation End of Year Report By Joseph Raczynski In the ever-evolving landscape of LegalTech, the past year has seen advancements that are reshaping how law firms both practice and operate. For small and medium-sized law firms, staying ahead of these trends is crucial not…

-

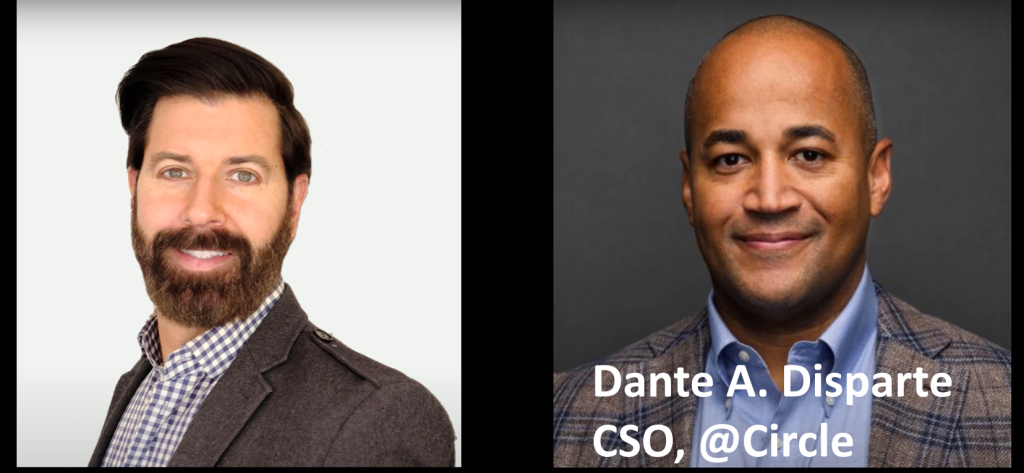

Stablecoins, Regulation, and the Road Ahead: A Conversation with Circle’s Dante Disparte

Today, I’m thrilled to welcome Dante Disparte, Chief Strategy Officer at Circle—a cornerstone in the world of stablecoins and global payments innovation. With a name like Dante, it’s fitting that he’s helping guide the crypto industry through what sometimes feels like the nine circles of regulation. But don’t worry, this journey ends not…

-

Can you still spot a DeepFake? Michael Jung Prepares Us – DeepBrain AI

In today’s episode, we’re diving headfirst into the tangled web of generative AI, deepfakes, and their potential to upend what we know as real. With the stakes higher than ever, we’re joined by Michael, a leading voice in the fight against AI-generated misinformation. He’ll guide us through how cutting-edge deepfake…

-

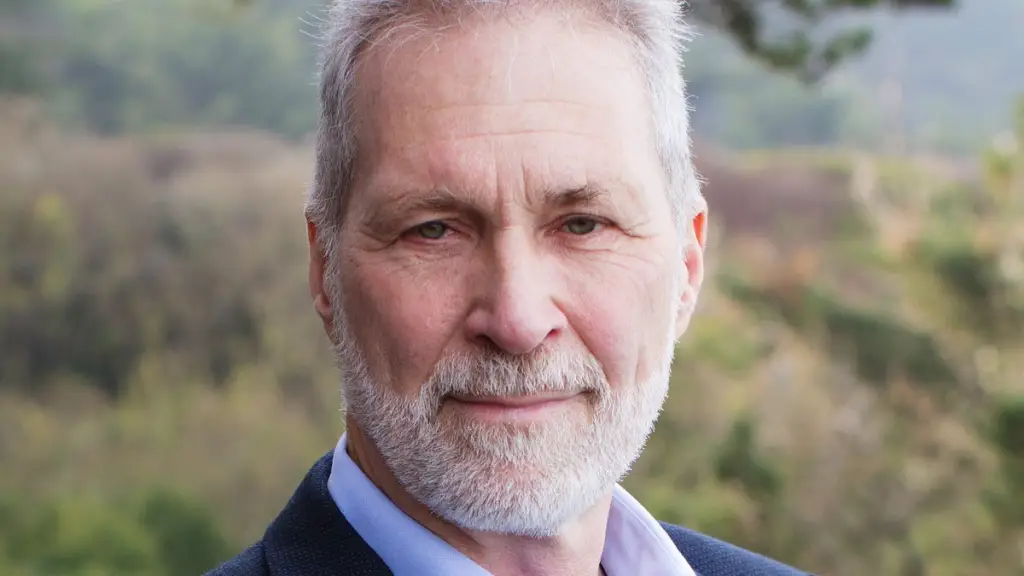

Ready for the Future of AI and Politics? Gary F. Bengier, Writer, Philosopher & Technologist

Gary is a famous Silicon Valley Technologist (he’s the former eBay CFO!) and Philosopher with a fascinating & well informed view on the future of AI & Politics. Today we will hear his pearls of wisdom as he shares insights and actionable advice about the future of AI and the…

-

Exploring the AI Vanguard: Top 50 Companies Shaping 2024

Artificial intelligence continues to rewrite the rules of innovation in 2024. From healthcare breakthroughs to generative art revolutions, the top 50 AI companies of the year exemplify the transformative power of technology. In reviewing the WriterBuddy article, several key themes emerge—illustrating not just who leads the charge, but why their…

-

McKinsey & Company Says… Big Changes – Prepare for the Future of Work – Dana Maor, Senior Partner

Today we focus on AI and jobs, especially with the Journey of Leadership. A new McKinsey survey cites that nearly all employees (91%) report using generative AI in their work and the vast majority are enthusiastic about it. This is a significant change from a survey they conducted six months…

-

Binance Protecting Your Funds with Gwen Regina

This was an amazing conversation with Gwen Regina, formally Investment Director, BNB Chain, Binance. We dive into Gwen’s perspective on BNB Chain and BNB Chain’s Red Alarm feature, implemented to protect investors from potential rug pulls and scams, flags projects based on two main criteria: if the contract performs differently…

-

What Future Blockchain Looks Like with Sandeep Nailwal of Polygon

What does the future of blockchain and cryptocurrency look like? Away from the din of 18,000 people at a recent conference, Sandeep Nailwal, CEO of Polygon and I caught up. This covers all things Layer 2 and the Merge coming from the Ethereum upgrade. Sandeep has a unique and deep understanding…

-

What is Privacy on the Blockchain? Zcash and Josh Swihart have ideas.

At the Austin Convention Center at the Consensus conference, Josh Swihart, SVP of Marketing at Zcash, and I caught up. This covers off on the original privacy token built in the spirit of Bitcoin but with ZKP properties for privacy and security. Josh has been in this space for over 10…

-

Is Gaming Going All In on Web3? Robby Yung Talks Shop

I met with Robby Yung CEO of Animoca Brands. This is one of the largest and most progressive Web3 companies around. They have a huge number of investments and projects they are involved with. We get into a host of different topics including where the company is headed, what they…

-

Checkmate on Privacy: Garry Kasparov on Security & Blockchain

In the speaker’s green room at the Consensus conference, Garry Kasparov, Chess Grandmaster, and I caught up. This covers all things cryptocurrency and his belief in the importance of the technology to create more freedom for people across the world, especially in areas with more authoritarian regimes. It is a…

-

Is Social Media Doomed? Billionaire Frank McCourt’s Bold Solution

My conversation with Frank McCourt, Founder at Project Liberty, about the state of the world surrounding social media and why decentralization could be the answer. Project Liberty aims to create a new civic architecture for the digital world that returns the ownership and control of personal data to individuals, embeds…

-

Tech Snippets Today – Perry Carpenter – Chief Human Risk Management Strategist – KnowBe4

Today, any image, video, or audio can be fabricated to extent that it is nearly, or almost impossible to tell. This show focuses on how we can combat AI deepfakes, deception and disinformation. My guest Perry Carpenter – Chief Human Risk Management Strategist at KnowBe4 has written a book, “FAIK:…

-

Hitting the Trifecta for AGI: A Journey Toward Artificial General Intelligence

AGI is likely around the corner. We need to mentally prepare for it. Here are three avenues as I see this unfold. Recently at a talk in Boston, I walked through these concepts with the audience. Quick Step Back: The adult brain has approximately 100 billion neurons, it orchestrates over…

-

Tech Snippets Today – Asher Lohman – VP of Data & Analytics at Trace3 with Joseph Raczynski

Today, we uncover how AI is reshaping the fight against fraud! With Asher Lohman, VP of Data Analytics at Trace3 we’ll crack open the magic of machine learning—spotting sneaky behavior, detecting anomalies, and sending real-time alerts faster than ever. Can AI outsmart fraudsters while keeping pace with their tricks? You’re…

-

Tech Snippets Today – Alejo Pinto – Co-founder of Pontem with Joseph Raczynski

According to Dapp Radar, the decentralized application (DApp) industry is flourishing with a new all time high at 15.9 million unique active wallets in July 2024, a 78% increase over June’s total. Today we are going to dive into this space and how Lumio plays a role. We delve into…

-

What is a Photo Anymore?

In an era where technology advances at breakneck speed, the concept of a “photo” is rapidly evolving. Once, a photograph was a static representation of a moment in time, a slice of reality captured by a lens. Today, however, the boundaries between reality and artificiality are becoming increasingly blurred, especially…

-

The Age of Addictive Intelligence: How AI will Reshape Our Relationships and Lives

Soon: A world where your best friend is a chatbot, your therapist is an algorithm, and your romantic partner exists only in code. You laugh – it’s very possible. As AI becomes more sophisticated, it’s not just enhancing our lives—it’s entwining itself into our most intimate relationships, creating an addictive…

-

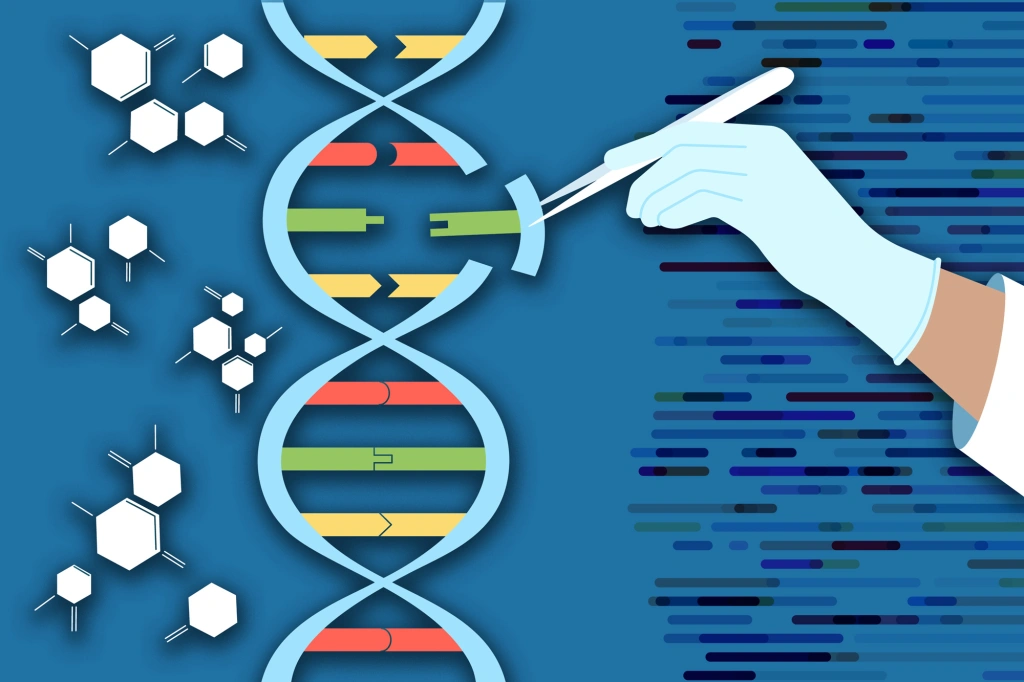

CRISPR: The Future of Humanity

If you have a baby today, it is highly likely the child will live until they are 125 years old. Many years ago, I used this teaser introduction slide in my presentations to shift the audience’s mindset about what incredible advances are to come overall with technology. Well, the technology…

-

Tech Snippets Today – Harrison Hines – CEO – Fleek with Joseph Raczynski

Edge computing has become one of the hottest trends in cloud computing as businesses seek to reduce latency and improve user experience by processing data closer to the source. However, centralized edge networks controlled by a single provider offer few benefits over existing cloud infrastructure with glaring cost, scalability, and…

-

Tech Snippets Today – Holly Levanto – VP AI Practice – Booz Allen with Joseph Raczynski

This was a wonderful opportunity to speak with Holly Levanto, VP in Booz Allen’s AI practice about the current and future uses of AI. Artificial intelligence (AI) is rapidly transforming military operations and strategies, offering unprecedented capabilities in areas such as surveillance, data analysis, and autonomous systems. AI-driven technologies can…

-

The Potential of Predictive Markets: A Revolution with Polymarket

Predictive markets have long fascinated economists, investors, and curious minds alike. I have been following and investigating them for almost the last ten years. The first such market was called Augur. So, what are these predictive markets and why will they become increasingly important? Predictive markets offer a window into…

-

Tech Snippets Today – Ian Rogers – CXO at Ledger with Joseph Raczynski

If you have ever wondered what the minds behind the biggest hardware wallet are like, this is for you. What an amazing conversation with Ian Rogers, CXO at Ledger. We dove into their newest kid on the block, Ledger Stax. In this video we get our first hand-on with the…

-

“The State of AI” – MIT EmTech Digital Conference

Recently I attended the annual EmTech Digital conference at MIT in Cambridge, MA. The most influential companies in AI from around the world presented to a group of 200. The “State of AI” session at the MIT EmTech Digital conference was opened by Nathan Benaich, founder of Air Street Capital,…

-

Tech Snippets Today – Daniel Fogg – CEO at RootstockLabs with Joseph Raczynski

This company is one of the OG in the industry. I really enjoyed this conversation with Daniel Fogg, CEO at RootstockLabs. We met at the recent Consensus conference in Austin. Their combination of history with Bitcoin and what they are doing to build decentralized applications by bringing Ethereum smart contracts…

-

“Digital Content Authentication” – MIT EmTech Digital Conference

In today’s digital age, the authenticity of online content is more critical than ever. With the rise of deepfakes, manipulated media, and synthetic content, ensuring the transparency and trustworthiness of what we see and hear online has become a paramount concern. Mounir Ibrahim, Executive Vice President of Public Affairs and…

-

Tech Snippets Today – Greg Osuri – Founder at Akash with Joseph Raczynski

What a world we live in today. We now have decentralized cloud computing. This is a thing. It will be an important means for businesses to access increasingly vital compute. I had an amazing opportunity to chat with the founder of Akash at Consensus recently. We dive headlong into the…

-

“From the Labs of OpenAI” – MIT EmTech Digital Conference

In the ever-evolving landscape of artificial intelligence (AI), it’s easy to be swept up by utopian dreams or dystopian fears. But what does the future of AI really hold? Srinivas Narayanan, Vice President of Applied AI at OpenAI, recently shared his insights at the “From the Labs of OpenAI” session,…

-

Tech Snippets Today – CahillNXT at Consensus with Joseph Raczynski

What impact might current legislation have on digital assets? How can someone navigate through the complexities of cryptocurrency rules and regulations? This was an insightful conversation with two gurus of digital assets from CahillNXT, at the law firm Cahill. I met with Samson A. Enzer and Lewis Rinaudo Cohen at…

-

“Creating a Safe and Thriving AI Sector” – MIT EmTech Digital Conference

The session “Creating a Safe and Thriving AI Sector” at the MIT EmTech Digital conference was led by Asu Ozdaglar, the Deputy Dean of Academics at MIT’s Schwarzman College of Computing. With the poise of a seasoned orator and the precision of a chess grandmaster, Ozdaglar dove into the labyrinth…

-

“Liquid Neural Networks” – MIT EmTech Digital Conference

The world of artificial intelligence is brimming with innovation and complexity, but nothing quite matches the potential of liquid neural networks. At the recent “Liquid Neural Networks” session at MIT EmTech Digital Conference, Ramin Hasani, CEO of Liquid AI, offered a compelling glimpse into this cutting-edge technology and its transformative…

-

Tech Snippets Today – Zach Burks – CEO & Founder at Mintable with Joseph Raczynski

Are you sleeping on the potential of NFTs? Today I had a fantastic chat with Zach Burks, CEO & Founder at Mintable. As we all know now, NFTs, or non-fungible tokens are a derivative of blockchain technology. The mania peaked in 2021 with the likes of Bored Apes and CryptoPunks,…

-

“AI Goes to Court” – MIT EmTech Digital Conference

The session “AI Goes to Court” at the MIT EmTech Digital conference was led by Amir Ghavi, AI, Tech Transactions & IP Partner at Fried Frank LLP. Ghavi, who represents several prominent AI companies such as Stability AI, took the stage with a lively and engaging presentation, acknowledging the challenge…

-

“Decentralized AI” – MIT EmTech Digital Conference

In the ever-evolving landscape of artificial intelligence, decentralization is emerging as a critical paradigm shift, promising to revolutionize how we handle data, privacy, and AI capabilities. At the “Decentralized AI” session, Ramesh Raskar, Associate Professor at MIT Media Lab, provided an illuminating and thought-provoking perspective on this topic. Here’s an…

-

Tech Snippets Today – Petra Molnar, Harvard Faculty Associate, Lawyer, and Anthropologist with Joseph Raczynski

Today we focus on migration and technology, and the people caught in the middle. My guest, Petra Molnar, has written: The Walls Have Eyes: Surviving Migration in the Age of Artificial Intelligence offers a global story of the sharpening of borders through technological experiments while also introducing strategies of togetherness…

-

OpenAI’s New GPT-4o Allows Voice and Video in the Same Model

What’s New? OpenAI just debuted GPT-4o, a new kind of “Omnimodel” or multimodal AI model that you can simply communicate with in real time in a live voice conversation. There is also the ability to use video streams from your phone or computer and text. Impressively, the model will be…

-

Tech Snippets Today – Author and Futurist, Bernard Marr with Joseph Raczynski

The AI Act was signed into law in the EU recently. In addition, the UK and US signed a landmark deal to work together on testing advanced artificial intelligence—both countries will now work together on developing ‘robust” methods for evaluating the safety of AI tools and the systems that underpin…

-

The Future of Geopolitics and the Role of Innovation and Technology

Washington, D.C., Walter E. Washington Convention Center – In the whirlwind world of technology and geopolitics, the recent panel discussion on “The Future of Geopolitics and the Role of Innovation and Technology” offered a fascinating blend of perspectives from esteemed experts, including Alex Karp, Cofounder and CEO, Palantir; David S.…

-

Tech Snippets Today – Anurag Dhingra, CTO and Head of Engineering at Webex by Cisco with Joseph Raczynski

This was an extremely refreshing conversation with Anurag Dhingra, Chief Technology Officer and Head of Engineering at Webex by Cisco. He has a deeply technical background and has risen through the ranks to focus on the importance about generative AI in the workplace. In today’s tech-dependent world, Cisco notes the…

-

Data Governance – What the Future May Hold – Dubai Future Forum

Recently at the Dubai Future Forum, they gathered several presenters together and posed some interesting questions to us about data governance, privacy and the future of the space. Here are some thoughts from me and some of my colleagues from the event. This was filmed before I left my previous…

-

Tech Snippets Today – Gerald Heydenreich – Founder – EtherMail with Joseph Raczynski

I was delighted to have Gerald Heydenreich, Founder of EtherMail. In case you have not heard, interactions with NFTs, cryptocurrency, and all things blockchain can be a bit painful to control. Not anymore! Recently EtherMail launched its Email-as-a-Wallet (EaaW) solution, enabling users to create non-custodial wallets through Gmail or Apple…