EmTechMIT, Cambridge, MA: Robert Bench, CEO and Cofounder of Radius Technology Systems, brought a bold and nuanced vision of the future to EmTechMIT, sparking the kind of dialogue that strikes at the core of technological progress: how do we truly enable an internet where value can be transferred as fluidly as information? Bench’s breadth of experience, which includes roles at the Federal Reserve and Circle, as well as advising MIT Media Lab initiatives, lends both authority and grounded optimism to this mission.

The Two Internets: Data vs. Value

Bench began by establishing an essential historical context. The “original sin” of the internet, as he calls it, was a disjointed approach: the 1990s brought open standards for data and communication, championed by visionaries like Tim Berners-Lee, but financial institutions like Visa and the Federal Reserve balked at integrating value transfer capability into the same global network. “It’s so, since about the mid-nineties, we’ve actually had two internets,” Bench observed. “One is open data, open communication. The other is money. Money logic runs from the Federal Reserve Bank in New York.” This foundational split shaped the market-driven, ad-centric model that dominates digital business.

The unintended outcome? Revenue models based on advertising and attention-grabbing design, forcing “the chemicals in your bodies to do one more click, one more swipe, one more scroll,” Bench quipped, referencing the psychological engineering behind modern social networks and platforms. He points out, “There’s no technical reason why the bottom of your news feed or your Twitter feed should bounce. But they bounce because psychologists in Vegas told them the bounce ups the bounty.”

The Hard Leg of the Problem: Monetizing the Unmonetized

Emphasizing that technologists at MIT approach these challenges from a problem-solving vantage point, Bench shifted to ask: what’s the “hard leg” or the bottleneck in tech to building a true internet of value? In his own words, “The overwhelming quantity of the world’s goods and services are not properly monetized.” Today’s value economy has massive blind spots, data points, computation cycles, neural network inferences, and niche digital services all remain stranded, unable to be traded affordably or seamlessly.

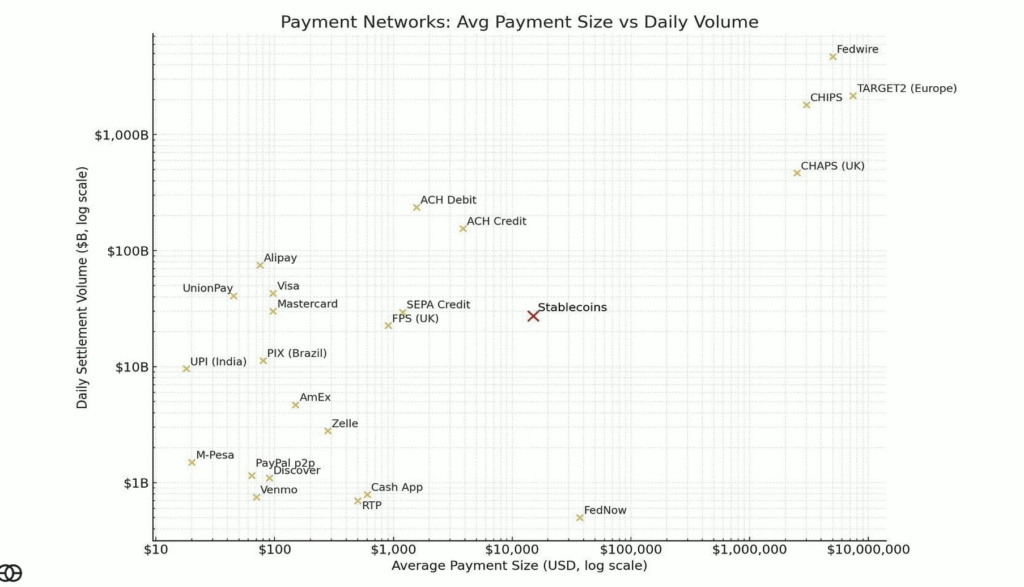

Bench illustrated this with a microeconomics lens: “It’s almost impossible to pay for anything under $1, and the overwhelming amount of goods and services in the world cost much less.” The market for small transactions or micropayments was stunted by legacy financial rails that prioritize large payments and batch processing over granularity and speed.

Protocols for Authority: Payment Required

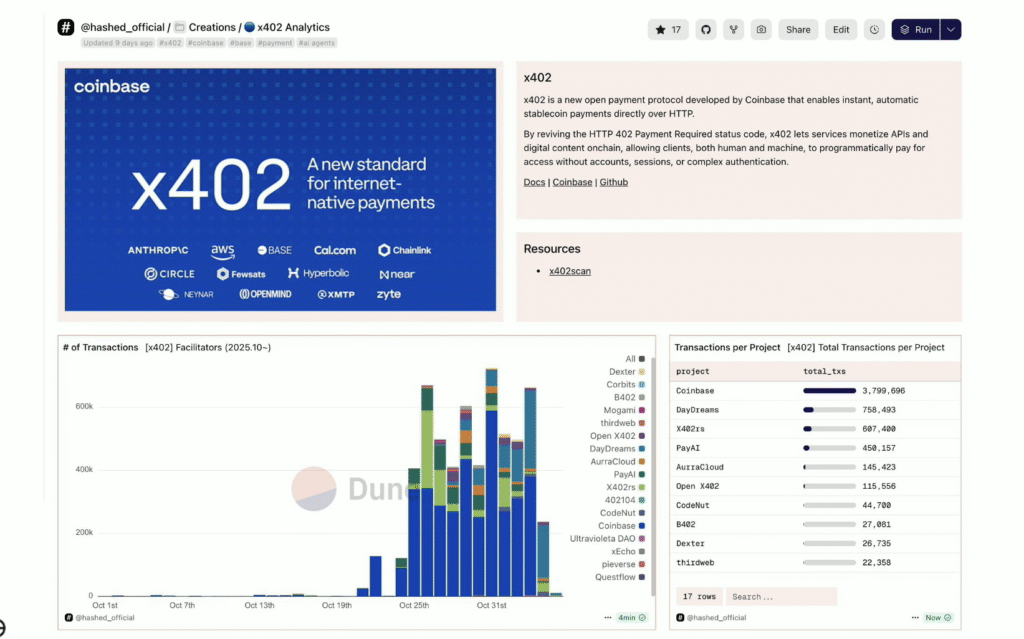

Here, Bench introduced the payment-required HTTP x402 code. As he explained, “So what it does is give an agent the authorization to spend.” The vision is straightforward yet transformative: AI agents and software applications become empowered to buy and sell compute, data, and digital services, transacting natively across the internet. With 402, “you can set [the code] up and you can basically require someone to have a transaction,” transforming how permissions and payments are negotiated online.

Scaling up to meet real-world needs, Bench reported, “We’re starting to see massive increases in use for 402 protocols to start allowing, introducing our activity to have authorities to spend.” According to Bench, this protocol is foundational for unlocking latent economic activity, making data streams and micro-computed insights tradable down to fractions of a cent.

Why Microtransactions Finally Matter

Bench’s advocacy for micropayments isn’t just philosophical; it’s practical. Years of transaction fee friction, batch processing bottlenecks, and centralized settlement delays have rendered small transactions nonviable, sidelining innovation in digital commerce. The goal: infuse the payment layer with the same flexibility that underpins the web.

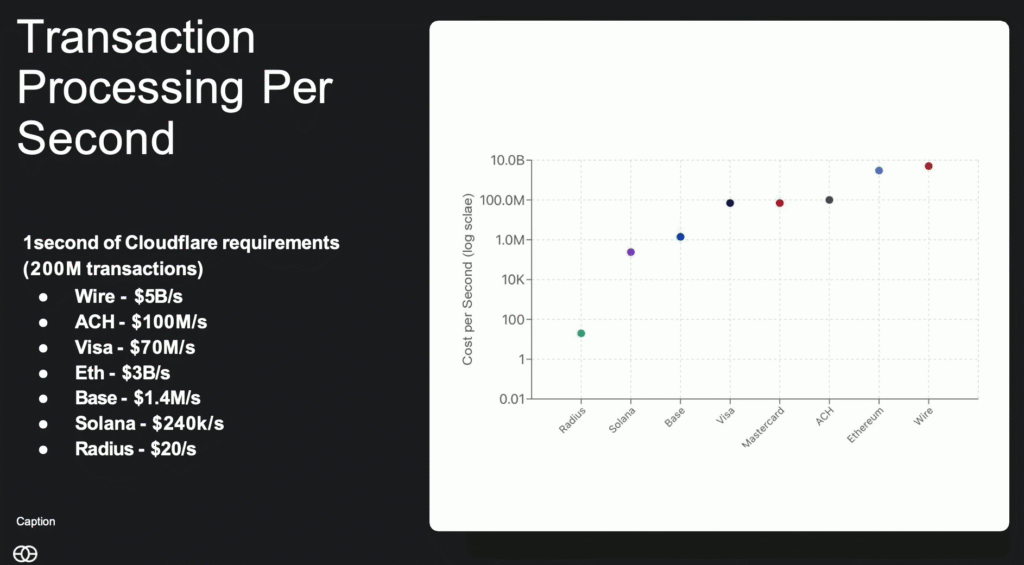

Bench described Radius’s solution: “Base and Radius are now taking on Visa, which is instead of 25 basis points, Base now charges about a penny or fractions of a penny. It’s 0.0000001 for an action or ad on Facebook.” The implication is profound: if Radius and similar architectures proliferate, swipes and clicks could trigger payments so small they become nearly invisible, a true machine economy for digital services.

Architectures for the Future: Decentralization vs. Centralization

Audience questions pressed Bench on how Radius compares to decentralized architectures like Ethereum regarding security, stability, and scalability. Bench challenged the Bitcoin-style maximalist view: “You do not need Bitcoin-style decentralization to execute token values like staying.” Instead, the Radius approach is globally distributed, but not rigidly decentralized, focused on minimizing latency and cost while retaining enough openness for agent-based commerce.

He acknowledged limits in blockchain-based systems: “There is upper limits [to] scalability if you structure your specific database into a party format, you will have upper limits on answer of the calling.” Put differently, no blockchain is infinitely scalable, and different use cases demand different trade-offs between security, speed, and openness.

New Business Models: Toward Agent-Based Commerce

Business models are shifting accordingly. Bench predicts a move away from ad-centric models toward transaction-based architectures, where AI agents autonomously purchase access to data, computation, and insights at micro scale. “The entire user interface of the internet might change because it’s not focused on [capturing] users’ attention. It’s focused on getting the data fast and cheaply to the agent that needs it for the day.”

Challenges and the Road Ahead

Bench’s views are ambitious but tempered with realism. “We have yet to find our plea for the scalability here. Every addition of compute, every addition of an agent, makes the system faster, but it makes it relatively expensive.” Scaling these systems, and getting both technologists and business leaders to buy in, demands rethinking incentives and overcoming deeply embedded systems.

Whether it’s machine learning, healthcare, or cloud logistics, the internet of value is poised to rewire how information and capital move. A vision made possible when technology solves the ‘hard leg’ of latent monetization.

For more information, please visit the following:

Website: https://www.josephraczynski.com/

Blog: https://JTConsultingMedia.com/

Podcast: https://techsnippetstoday.buzzsprout.com

LinkedIn: https://www.linkedin.com/in/joerazz/

Leave a Reply

You must be logged in to post a comment.