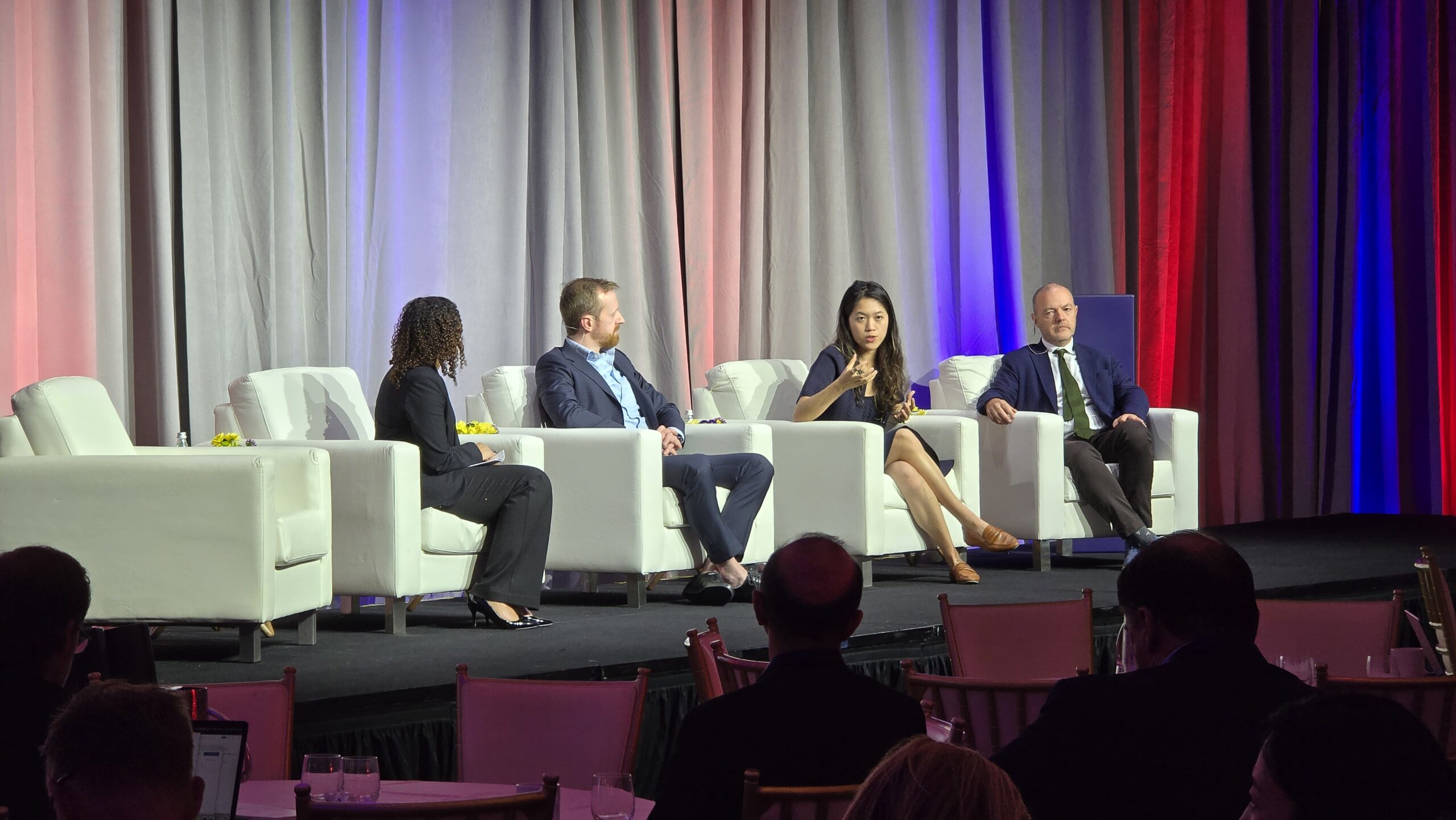

At the AI+ Science Summit held at the Waldorf Astoria in Washington, D.C., a dynamic session entitled “Bridging the Gap from Lab to Market” convened leading voices from philanthropy, venture capital, and strategic science funding. Moderated by Nyah Stewart of SCSP, the panel, Vinny Beranek of Engine Ventures, Michelle Fang of Lux Capital, and Walter Sweet of Rockefeller Philanthropy Advisors, explored the evolving landscape of translating scientific breakthroughs into tangible impact amid shifting funding paradigms.

A New Era for Science Translation

Nyah Stewart opened by highlighting the urgency of this conversation: traditional federal funding for R&D faces decline, while philanthropy and venture capital step in to accelerate and scale science in novel ways. The question is not just how to fund science, but how to rethink the entire ecosystem from discovery in academic labs to commercial deployment.

Philanthropy as Risk Capital and Ecosystem Builder

Walter Sweet emphasized philanthropy’s unique role as flexible, risk-tolerant capital that fills gaps left by government and industry. Philanthropic funders can back early-stage, high-risk projects with uncertain profit motives but transformative potential. Rockefeller Philanthropy Advisors supports initiatives that bring together industry leaders and innovators, creating opportunities where scientific solutions can grow and attract follow-on investment, a blend of vision and pragmatism.

Navigating the “Valley of Death” in Deep Tech

Vinny Beranek discussed Engine Ventures’ mission to help researchers cross the notoriously treacherous “valley of death” between laboratory discoveries and commercial enterprises. This transition is fraught with challenges including long development timelines, enormous capital requirements, and the complexity of moving from code or proof of concept to deployable hardware or products. The panel recognized that bridging this gap requires patience, continued funding, and experienced operational guidance around business-building—not just technology development.

“Multidisciplinarity” and Building Bridges Across Sectors

Michelle Fang focused on the need for multidisciplinary collaboration and technical architectures that span AI, quantum computing, biotechnology, and robotics. Lux Capital’s recent science-focused program commits substantial resources to support scientists facing challenges from visa issues to funding gaps, helping shepherd promising technologies from concept to market. The approach is holistic, cultivating a vibrant ecosystem involving universities, accelerators, philanthropic organizations, and venture funds to unlock science’s full potential.

Bridging Funding Ecosystem Silos

Panelists underscored that no single funding source suffices. Government investment remains indispensable for foundational research, but philanthropic and venture capital contributions are critical for scaling and de-risking later stages. However, philanthropy is voluntary and driven by individual passions, making sustained, coordinated efforts challenging. The government’s role includes providing consistent, long-term support and creating incentives for private sector participation, particularly in capital-intensive areas like energy and quantum technologies.

Talent Retention: The Competitive Edge

A recurring theme was the imperative to retain global STEM talent in the U.S. Michelle Fang highlighted that immigration policy, welcoming environments, and clear career pathways are vital to sustaining America’s innovation advantage. Losing talented researchers or entrepreneurs to other countries risks ceding strategic scientific leadership.

Practical Advice for Founders and Researchers

Closing the session, the panel shared distilled wisdom for early-stage scientific entrepreneurs:

- Vision Alignment: Clearly define and align the team around a compelling mission.

- Build Strong Teams: Hire credible, multidisciplinary talent that complements scientific expertise.

- Financial Discipline: Never run out of capital, fundraising and managing financial runway is critical.

- Commitment to the Long Haul: Prepare for a multi-year journey; find partners you want to grow with over time.

- Market Awareness and Agility: Understand market dynamics and remain ready to pivot as needed.

Key Policy Takeaways

Panelists offered thoughtful recommendations for improving the R&D-to-market pipeline:

- Enhance coordination among government, philanthropy, and venture capital to ensure seamless support across stages.

- Foster more multidisciplinary, problem-focused research that incentivizes applied outcomes without neglecting foundational science.

- Encourage policies that make U.S. immigration welcoming to STEM talent to maintain a competitive innovation workforce.

- Support mechanisms that reduce the “valley of death” risk, particularly in capital-intensive sectors like energy, fusion, and advanced manufacturing.

Final Thoughts

This session illuminated a fundamental truth: the path from lab discovery to commercial impact is no longer linear or reliant on any single player. It demands an ecosystem approach that integrates funding, expertise, and collaboration across sectors. As government funding ebbs, philanthropy and venture capital are rising to fill gaps but require thoughtful coordination.

For policymakers, industry leaders, and scientists aspiring to convert breakthroughs into societal benefit, the challenge is clear: foster flexible, multidisciplinary ecosystems; nurture talent; and align incentives to support long-term, bold scientific ambitions.

In a world where national security increasingly hinges on scientific and technological leadership, bridging the gap from lab to market is not just good economics, it is a strategic imperative.

For more information, please visit the following:

Website: https://www.josephraczynski.com/

Blog: https://JTConsultingMedia.com/

Podcast: https://techsnippetstoday.buzzsprout.com

LinkedIn: https://www.linkedin.com/in/joerazz/

Leave a Reply

You must be logged in to post a comment.