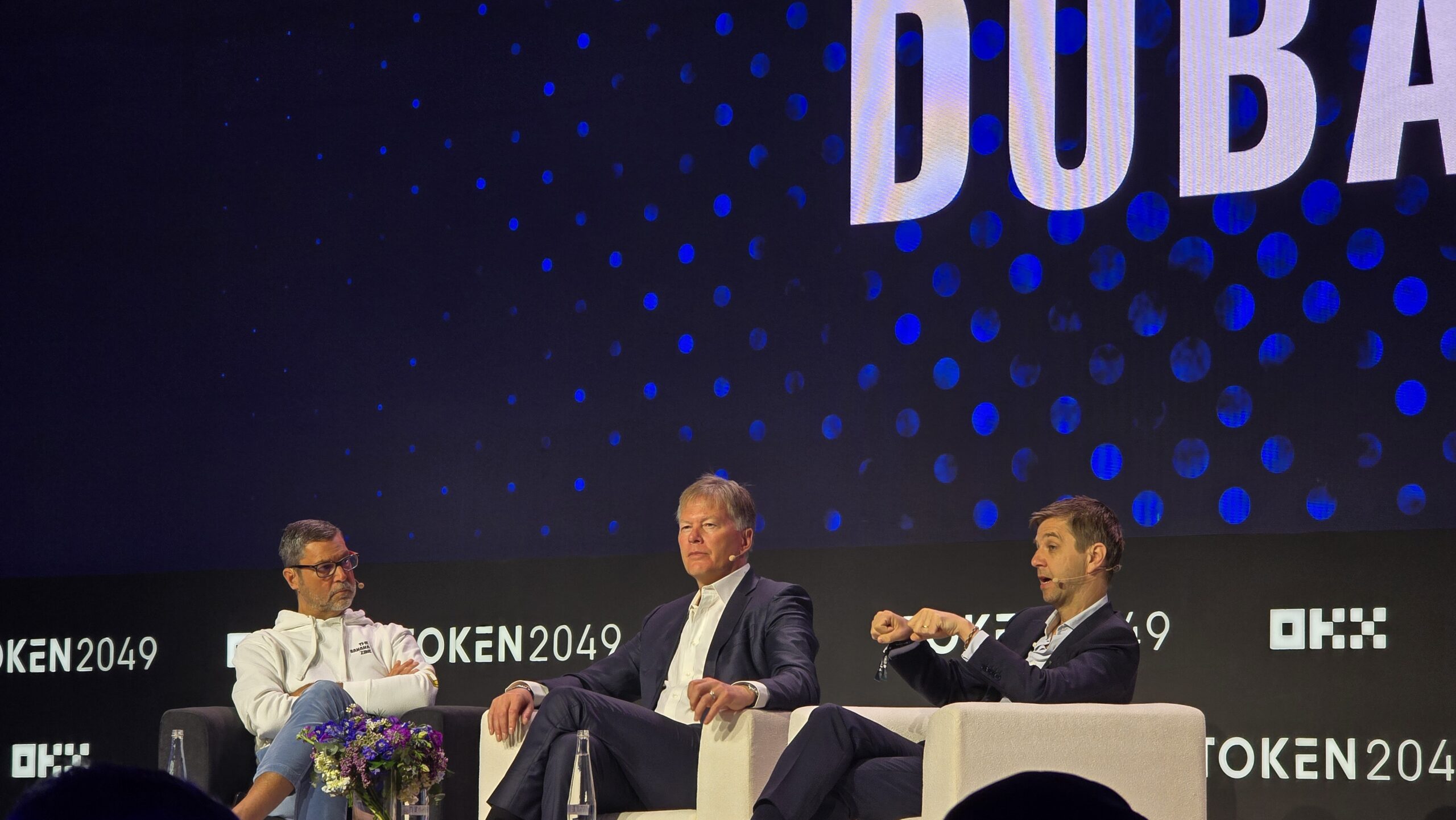

Dubai, UAE, Token 2049: A recent panel featuring Raoul Pal (Real Vision), Dan Morehead (Pantera Capital), and Zoltan Pozsar (Ex Uno Plures) tackled one of the most urgent questions in finance today: Can crypto not just survive, but thrive amid mounting global macroeconomic chaos? Their wide-ranging discussion, though at times meandering, because with such a dynamic group, this is not just expected but welcomed, they offered a deep dive into the shifting tectonics of global trade, monetary policy, and the evolving role of digital assets.

A New Economic Paradigm: Fractured Systems and Shifting Priorities

The speakers unanimously agreed that the world is entering a new economic paradigm. The century old system of global trade and finance-built on the US dollar’s dominance, open markets, and complex supply chains-is under strain. Trade wars, rising tariffs, and geopolitical tensions are shaking the foundations of the postwar order, creating ripple effects across asset classes.

Traditional investments like stocks and bonds are no longer providing the safety or returns investors expect. Dan Morehead likened the current macro environment to a shaken snow globe, where old certainties are upended and volatility reigns. The contradiction of high bond yields and elevated stock prices signals deep market uncertainty, while persistent inflation and policy missteps add further complexity.

Crypto as a Safe Haven and Disruptor

Against this backdrop, the panelists highlighted crypto’s unique role. Morehead emphasized that crypto is increasingly seen as a safe bet in a world where traditional assets are failing to deliver. Crypto’s appeal lies in its disconnection from the legacy financial system, offering an alternative not just for investors, but for entire economies seeking to hedge against currency debasement and systemic shocks.

Zoltan Pozsar added that while the dollar remains the world’s reserve currency, its primacy is being challenged-not just by gold, but by digital assets like Bitcoin. He argued the world is moving toward a more balanced framework, where surplus is not just about accumulation, but about how it is stored and protected. In this context, assets like gold and Bitcoin are gaining legitimacy, even as governments begin to explore their potential roles in the financial system.

Raoul Pal pointed out crypto’s democratizing effect: its fractional nature allows anyone, anywhere, to participate, potentially leveling the playing field that has long favored the financial elite.

Macro Drivers: Trade Wars, Policy Shifts, and De-Dollarization

The discussion repeatedly returned to the macro drivers shaping crypto’s trajectory:

- Trade Tensions and Tariffs: The escalation of US-China trade frictions is fueling inflation and economic uncertainty globally. While this initially drives risk aversion and strengthens safe-haven assets like gold, it also increases interest in crypto as a hedge against both inflation and geopolitical risk.

- Monetary Policy Uncertainty: With central banks hesitant to cut rates and fiscal deficits ballooning, investors are wary of further currency debasement. Crypto’s fixed supply and independence from central bank policy make it an attractive alternative, especially as traditional safe havens become less reliable.

- De-Dollarization and Cross-Border Flows: Emerging markets, wary of the dollar’s weaponization, are exploring digital currencies and tokenized assets for cross-border settlements. This trend indirectly boosts the strategic value of public blockchains and stablecoins, as capital seeks new routes around traditional financial chokepoints.

On-Chain Data: Macro Trends Now Drive Crypto Markets

Recent data underscores the panel’s thesis: macroeconomic expectations are now the primary driver of crypto market movements. Surges in Bitcoin and Ethereum prices have closely tracked shifts in macro sentiment, with trading volumes and on-chain activity spiking in response to policy announcements and geopolitical developments. Institutional flows are increasingly favoring Bitcoin as a macro hedge, while altcoins exposed to global trade remain more vulnerable to volatility.

Risks and Opportunities: Not All Smooth Sailing

The panelists cautioned that crypto is not immune to macro headwinds. Correlations with equities remain elevated, and tightening financial conditions could still pressure digital assets in the short term. However, the ongoing accumulation of Bitcoin by institutions, the supply shock from recent halvings, and growing adoption as a treasury asset suggest that crypto’s resilience is strengthening.

The Big Picture: Crypto’s Role in a Fragmented World

Ultimately, the conversation painted a picture of a world in flux-one where old economic models are breaking down, and new forms of value storage and transfer are rising to fill the void. Crypto, with its borderless nature and programmable scarcity, is uniquely positioned to benefit from this macro chaos. As governments and investors alike search for alternatives to the legacy system, digital assets are moving from the periphery to the center of the new financial order.

“Crypto is not just surviving the chaos-it’s thriving because of it,” one speaker noted “In a world where uncertainty is the only constant, optionality is everything.”

Key Takeaways:

- Global economic uncertainty is eroding trust in traditional assets and financial systems.

- Crypto is emerging as both a hedge and a disruptor, offering safety and democratization.

- Macro trends-trade wars, monetary policy, and de-dollarization-are now the main drivers of crypto markets.

- While risks remain, crypto’s resilience is growing, and its role in the global economy is set to expand.

As the panel concluded, the message was clear: In the age of macro chaos, crypto’s star is only beginning to rise.

For more information, please visit the following:

Website: https://www.josephraczynski.com/

Blog: https://joetechnologist.com/

Podcast: https://techsnippetstoday.buzzsprout.com

LinkedIn: https://www.linkedin.com/in/joerazz/

Leave a Reply

You must be logged in to post a comment.